Unlocking Philanthropy for Unincorporated Groups in the UK: Bridging Gaps with Charity Grants and Grant Making

Unincorporated groups are an important part of driving positive change in UK communities. However, their informal legal status makes it difficult for them to get necessary funding. This post looks at how grantmakers and charities are finding new ways to provide funding to these groups, supporting their mission for positive change.

Unincorporated groups often appear in response to an urgent need, or a need that has so far gone unrecognised.

Yet it is at this formative stage where these efforts risk being knocked off course. When driving change outside of formal structures, we can unconsciously recreate patterns that reflect existing power dynamics. Without conscious examination, the very dynamics and prejudices they aim to dismantle can become encoded into their DNA.

I’ve witnessed this unfold many times through studying social change efforts across sectors. Just as in startups, social movements, religious groups and more, a lack of robust governance can enable destructive cultures to proliferate if left unchecked.

Mature organisations and institutions put robust guardrails in place to mitigate these risks – governance boards, codes of ethics, community accountability structures. But unincorporated grassroots groups lack such carefully constructed scaffolding from the outset.

This isn’t automatically a negative. Too many rules can constrain the ability to nimbly innovate and respond to rapidly evolving circumstances. The agility of unincorporated efforts is often key to their impact.

But an absence of guardrails exposes them to great peril as well. Without clear decision-making processes, power dynamics, conflicts and unhealthy behavioural norms can metastasise in ways that undermine the very change they wish to seed.

The question becomes: how can we unlock resources and support for these unincorporated changemakers, while simultaneously ensuring robust structures are put in place to mitigate risks and uphold accountability?

In my years studying philanthropic flows, I’ve seen funders wrestle with this tension. They recognise the vital role unincorporated groups play as engines of grassroots transformation. But they struggle with how to direct funds in ways that obey necessary oversight and due diligence.

Traditional grantmaking processes erect barriers that systematically exclude these unincorporated efforts. Application requirements like registered charitable status, governing boards, annual audits and the like make grants utterly inaccessible for these informal collectives.

This arbitrary gatekeeping doesn’t serve anyone. It blocks desperately needed resources from flowing to those driving change in communities. It reinforces existing power disparities between the haves and have-nots in civil society. And it upholds an entrenched philanthropic model out of sync with the fluid, decentralised nature of modern movements.

However, I’ve also witnessed creative solutions emerging to resolve this dilemma in thoughtful ways. Approaches that unlock funding while fostering healthy governance and accountability. Chief among them is fiscal hosting.

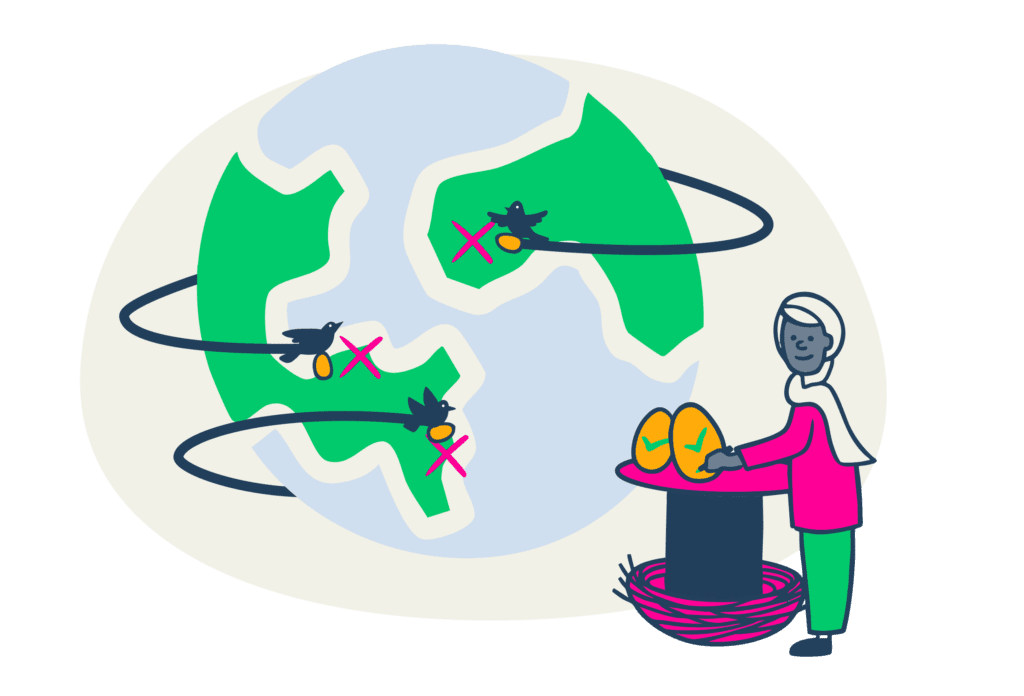

Through fiscal hosting, unincorporated groups receive a legal and administrative umbrella from an established sponsor organisation. The fiscal host receives and manages funding on the group’s behalf, handling due diligence, financial governance, reporting requirements and more.

For funders, this model alleviates concerns around investing in unincorporated groups. By relying on a reputable fiscal host as an intermediary, they can ensure proper policies and oversight while still resourcing grassroots efforts.

For the unincorporated group, fiscal hosting provides access to funding streams previously off-limits. It supplies expert governance support without crushing their limited capacity under tedious administration. The group’s energy remains focused on driving impact, not wrangling complexities.

In this arrangement, everyone’s interests get served. Funders meet their fiduciary duties. Grassroots leaders access resources with accountability. And more money flows to those best positioned to create transformative change.

Crucially, robust fiscal hosts put participatory structures in place for the groups they steward. Priorities, budgets and decisions ultimately reflect the voice and leadership of those embedded in the work. This mitigates saviour dynamics while fostering community ownership.

But freedoms and flexibility must be balanced with clear governance frameworks. Questions like decision-making protocols, grievance reporting channels, conflict resolution processes and more get carefully discussed from the outset. These collaboratively-designed structures provide essential scaffolding for healthy group dynamics as the work evolves.

Combined, fiscal hosting provides a holistic solution that aligns everyone’s interests. It marries flexibility and self-determination for unincorporated groups with robust due diligence and financial controls for funders. This elegant model uplifts grassroots changemaking while ensuring accountability to prevent misuse.

As this approach proliferates, new energy gets injected into philanthropic flows. Resources catalyse impactful work previously dismissed as too risky or informal. Collective wisdom replaces centralised expertise in determining where funds should be directed for maximum impact.

This helps funders move money with greater trust, leveraging the first-hand knowledge of those closest to the issues. It strengthens accountability loops, as money trails are more transparent and grantee-funder power dynamics get rebalanced. And audacious new models for driving change get rapidly prototyped and refined through nimble experimentation.

Ultimately, it represents a democratisation of philanthropy itself. Who defines impact? Who determines where funding flows? These questions get cracked open through more participatory grantmaking.

For visionary funders and unincorporated groups alike, this evolution holds tremendous promise. Through approaches like fiscal hosting, we can reshape antiquated systems to match the realities of modern civil society. We can bust open bottlenecks restricting the flow of resources towards transformative grassroots work.

There are risks, to be certain. Any shift this profound surfaces valid concerns around misuse, lack of oversight, conflicts of interest and more. But the greater risk lies in upholding the status quo – an entrenched model of philanthropic control out of step with the needs of this moment.

Safeguards must be put in place, to be sure. But they should facilitate participatory, transparent flows of money rather than concentrate decision-making power. Community-rooted governance, both for funders and the groups they resource, represents the wisest path forward.

Those willing to lean into this new paradigm hold an incredible opportunity in their hands. They can redesign philanthropic giving to match the radical creativity and fluidity of today’s most impactful social movements. In doing so, they become vanguards catalysing the systemic shifts our world urgently needs.

At the core of transformative change lies a humble recognition: the solutions often reside in the voices and lived experiences currently being overlooked. By evolving giving practices to amplify these voices, funders can redirect resources towards reinventing systems for true justice and collective flourishing.

The path forward involves letting go of outmoded structures to unlock new possibilities. It means entrusting the wisdom of those driving change in their communities. And it requires innovating novel ways to walk this delicate line between flexibility and accountability in service of a better world.

Interested in learning more?

Get in touch with a member of our team to hear more about how we can help you.