The Essential Guide to Choosing the Best Bank Accounts for Community Groups

Managing finances for your community group or charity can be a headache, but having the right bank account makes it so much easier.

What is a Community Bank Account?

Community bank accounts are designed to meet the specific needs of charities, clubs, and non-profit organisations. Crucially these accounts are in the name of the group rather than money being held in an individuals personal bank account.

Types of Community Bank Accounts

Community Current Accounts: These are ideal for community groups, clubs and small nonprofits and can be used for general day to day expenses and financial management.

- Natwest Community Account

- Royal Bank of Scotland Community Account

- Metro Bank Community Current Account

- Wave Community Bank

Treasurer’s Accounts: These are specifically designed for use by the treasurer of clubs and societies. They are useful if you have a dedicated treasurer and are dealing with larger amounts of money and/or need to maintain accurate records for tax reasons.

- Lloyds Bank Treasurer’s Account

- Bank of Scotland Treasurer’s Account

- Santander Treasurer’s Current Account (Note that Santander were among the top 10 investors of fossil fuels in Europe – see ethical considerations below)

Choosing the Right Bank Account for your Community Group

When it comes to choosing a bank, there are a few key things you’ll want to consider to make sure the account meets your community group’s unique needs:

Services They Offer

Make sure the bank provides essential services like online banking and debit cards if required. It’s also a good idea to pick a bank with convenient branch locations and solid online support in case you need it.

Ethical Alignment

If banking with an ethical institution is important to your group (which it really should be), you’ll want to evaluate a bank’s commitment to social responsibility. This can help ensure you align with your organisation’s values.

Application Process

The application process can vary significantly between banks. Some, like HSBC’s Charitable Bank Account*, let you apply online if you meet certain criteria, which can make getting started much easier. Bear in mind that even if you meet the application criteria the process can be lengthy and time consuming so be prepared.

*We’ve since heard a lot of people having challenges opening a community account with HSBC so you may want to start with one of the other options listed earlier.

Managing Your Community Bank Account

Effectively managing your community bank account is crucial for your groups financial stability and integrity. Having multiple people with oversight and signatory powers can prevent mismanagement and fraud.

Financial Transparency

Maintaining transparency in how your group’s funds are managed and spent is so important. Check how easy it is to regularly update and audit your accounts. This will help build trust with your community and donors.

Easy Access for Everyone

Choose an account that allows for easy access and management by multiple members of your organisation. This transparency is key, plus it ensures day-to-day transactions can be handled efficiently.

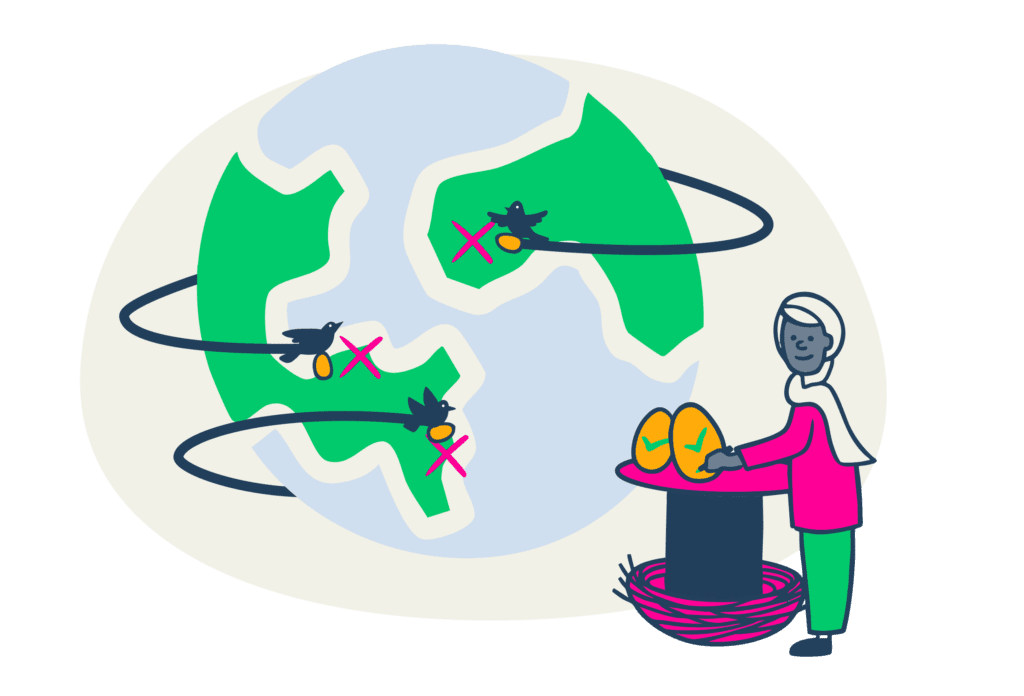

Alternatives to Opening a Community Bank Account

Can’t open a bank account right away or just need a temporary solution? Using a fiscal host might work for your situation. Fiscal hosts let you manage your money without having your own bank account.

Advantages of Using a Fiscal Host

- Quick Setup: Getting set up with a fiscal host is generally faster than opening a community bank account, which can be a lifesaver for new or short-term projects.

- Less Admin Work: By using a fiscal host, you can reduce the administrative burden that comes with managing a bank account yourself.

- You can apply for grants and funding opportunities: Fiscal hosts act as guarantors to groups that aren’t legally constituted (e.g. registered charity). With a fiscal host you’ll be able to use their legal status in order to apply for grants.

Frequently asked questions

What are the main benefits of a community bank account?

Unless you’re running a very small community group (and even then), keeping money in a personal bank account isn’t a good idea. A community bank account allows you to have the account in the name of the group rather than an individual. It also enables you to have multiple signatories.

Why do I need multiple signatories for a community bank account?

As well as reducing the responsibility and burden being carried by one individual, having multiple signatories reduces the risk of fraud or mismanagement of funds.

How do I choose the right bank for our community group?

Consider factors like what banking services you need, ethical policies that align with your values, and the convenience of the application process. On top of this, carefully review the eligibility criteria before applying.

I’ve been rejected for a community bank account. What should I do?

Ask for the reasons your application was rejected. It might be that another bank will accept your application. Consider alternative options such as fiscal hosting.

Looking for an alternative to getting a community bank account?

Join over 650 community groups and grassroots movements using fiscal hosting